The 7-Minute Rule for Hard Money Georgia

Wiki Article

What Does Hard Money Georgia Do?

Table of ContentsHard Money Georgia Things To Know Before You Get ThisThe Main Principles Of Hard Money Georgia The Definitive Guide to Hard Money GeorgiaThe 30-Second Trick For Hard Money Georgia

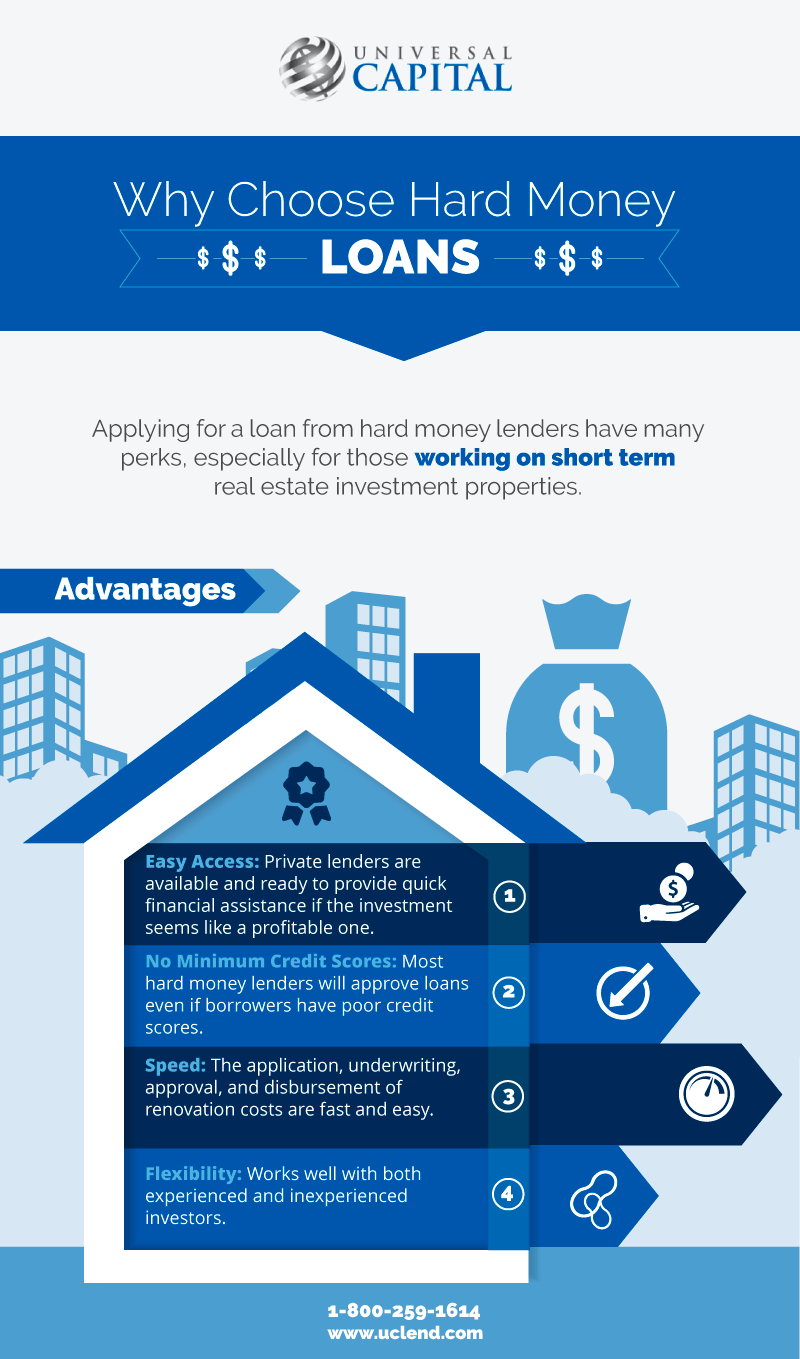

In the majority of areas, passion rates on tough cash financings run from 10% to 15%. In addition, a customer may require to pay 3 to 5 factors, based upon the complete lending quantity, plus any type of applicable appraisal, examination, and also administrative fees. Many tough money lending institutions require interest-only repayments throughout the short duration of the finance.Hard cash loan providers make their cash from the interest, points, as well as costs credited the borrower. These lenders want to make a quick turn-around on their financial investment, therefore the higher rate of interest prices and also shorter regards to hard money finances. A hard money lending is an excellent concept if a consumer requires cash rapidly to purchase a home that can be rehabbed and also turned, or rehabbed, leased and re-financed in a fairly brief period of time.

They're likewise great for capitalists that don't have a great deal of security; the home itself comes to be the collateral for the financing. Tough money loans, nevertheless, are not perfect for typical home owners wanting to finance a property long-term. They are a beneficial tool in the capitalists toolbelt when it concerns leveraging money to scale their service - hard money georgia.

For personal investors, the ideal part of obtaining a difficult money loan is that it is simpler than getting a traditional mortgage from a bank. The approval process is typically a lot less intense. Financial institutions can ask for a nearly unlimited collection of files as well as take a number of weeks to months to get a finance authorized.

Hard Money Georgia for Beginners

The main objective is to make certain the debtor has an exit technique as well as isn't in economic mess up. Many tough money lending institutions will function with individuals who don't have fantastic credit history, as this isn't their biggest problem. One of the most vital thing hard money loan providers will certainly look at is the investment home itself.

They will likewise examine the debtor's range of work and budget plan to guarantee it's practical. Sometimes, they will stop the procedure due to the fact that they either believe the residential or commercial property is as well far gone or the rehabilitation budget plan is impractical. Lastly, they will certainly evaluate the BPO or assessment and the sales and/or rental compensations to guarantee they concur with the evaluation.

However there is one more advantage built right into this procedure: You get a 2nd set of eyes on your bargain and one that is materially purchased the project's outcome at that! If a bargain is bad, you can be relatively confident that a difficult money loan provider won't touch it. You ought to never make use of that as a justification to abandon your very their explanation own due persistance.

The very best place to search for difficult money loan providers is in the Bigger, Pockets Difficult Cash Lending Institution Directory Site or your neighborhood Real Estate Investors Organization. Keep in mind, if they have actually done right by one more investor, they are most likely to do right by you.

More About Hard Money Georgia

Review on as we talk about difficult money financings and why they are such an attractive choice for fix-and-flip real estate investors. One major benefit of difficult cash for a fix-and-flip financier is leveraging a trusted lender's trustworthy capital as well as rate. Leveraging methods utilizing various other people's cash for investment. There is a danger to financing a purchase, you can free up your very own cash to acquire more residential properties.You can tackle projects incrementally with these tactical lendings that permit you to rehab with just 10 - 30% down (depending on the lender). Tough cash fundings are typically short-term financings made use of by investor to fund solution as well as flip properties or various other realty financial investment bargains. The residential property itself is made use of as security for the car loan, and also the top quality of the real estate offer is, as a result, much more vital than the consumer's creditworthiness when getting approved for the financing.

Nevertheless, this likewise suggests that the danger is greater on these lendings, so the interest rates are generally higher too. Take care of as well as turn financiers choose tough money because the marketplace does not wait. When the opportunity emerges, as well as you're all set to obtain your task into the rehabilitation phase, a tough cash financing obtains you the money straightaway, pending a reasonable visit the site analysis of business deal. hard money georgia.

Inevitably, your terms will depend on the difficult money lender you choose to function with and also your special situations. Here's a checklist of normal requirements or credentials. Geographic location. Most hard cash lending institutions operate locally or in particular regions. Several run country wide, Kiavi presently offers in 32 states + DC (as well as counting!).

Examine This Report about Hard Money Georgia

Intent and residential or commercial property paperwork includes your in-depth range of job (SOW) and insurance. To assess the residential property, your lender will certainly consider the value of similar residential or commercial properties in the location and also their estimates for growth. Adhering to an estimate of the residential or commercial property's ARV, they will certainly money an agreed-upon portion of that worth - hard money georgia.This is where your Range of Work (SOW) enters play. Your SOW is a file that information the work you intend to carry out at the building and also is normally needed by most difficult cash lending institutions. It consists of improvement costs, responsibilities of the events included, and, usually, a timeline of the deliverables.

For instance, let's presume that your residential or commercial property does not have actually a finished cellar, yet you are preparing to finish it per your range of job. Your ARV will be based upon the offered rates of comparable residences with ended up hard money georgia basements. Those rates are likely to be higher than those of residences without completed basements, therefore boosting your ARV as well as possibly qualifying you for a higher loan amount.

Report this wiki page